|

Med Insure Your Way

(317) 372-3070 Carmel, Fishers, Fort Harrison, Greenwood, Indianapolis, Martinsville, Noblesville, and Plainfield |

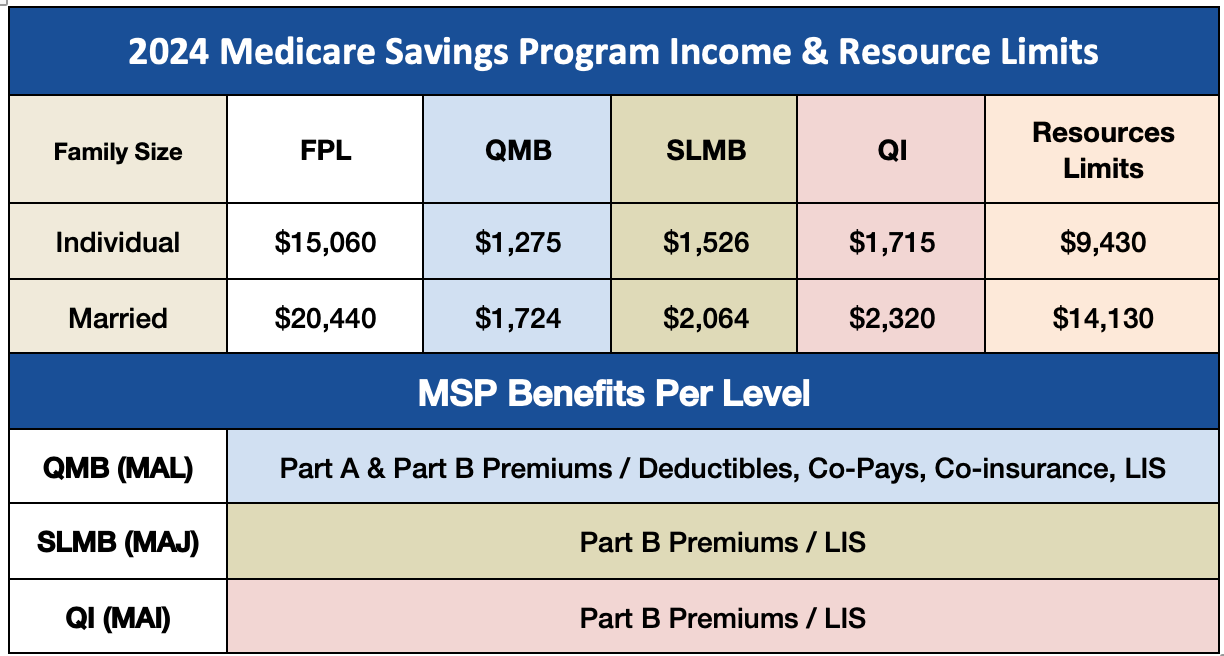

Medicare Savings Program (MSP) is one of four different Medicaid programs (QMB, SLMB, QI, QDWI) available for people with limited financial resources and, depending on a person's income and assets.

A Medicare beneficiary who qualifies for either the QMB, SLMB, or QI program will automatically qualify for the Medicare Part D "Extra-Help" program or commonly called low-income subsidy (LIS) that provides financial assistance with Medicare Part D prescription drug coverage (premiums and drug costs).

A Medicare beneficiary who qualifies for either the QMB, SLMB, or QI program will automatically qualify for the Medicare Part D "Extra-Help" program or commonly called low-income subsidy (LIS) that provides financial assistance with Medicare Part D prescription drug coverage (premiums and drug costs).

The Four Medicare Savings Programs include:

Your assets or financial resources that are included to determine whether you qualify for a Medicare Savings Program include any money in your checking or savings account and investments (such as, stocks and bonds).

However, when determining whether you are qualified for a MSP, your total assets or resources will not include: Your primary home, primary car, burial plot, minimal burial expenses, furniture and other household / personal items.

Please remember that asset or resource levels needed to qualify for a Medicare Savings Programs can (and usually do) change each year. For instance, in 2024, the resource or asset level for the MSPs are approximately:

To apply for a MSP, please contact your local state Medicaid office for more details and information on qualifying and applying for a MSP.

However, when determining whether you are qualified for a MSP, your total assets or resources will not include: Your primary home, primary car, burial plot, minimal burial expenses, furniture and other household / personal items.

Please remember that asset or resource levels needed to qualify for a Medicare Savings Programs can (and usually do) change each year. For instance, in 2024, the resource or asset level for the MSPs are approximately:

- QMB: Individual resource limit $9,430 and Married couple resource limit $14,130

- SLMB: Individual resource limit $9,430 and Married couple resource limit $14,130

- QI: Individual resource limit $9,430 and Married couple resource limit $14,130

- QDWI: The income limits for the Qualified Disabled and Working Individuals (QDWI) program in 2024 are $5,105 for an individual and $6,899 for a couple. These limits are subject to change based on cost-of-living adjustments made by the Social Security Administration. Additionally, to be eligible for the QDWI program, you must be between the ages of 16 and 64, and you must be receiving Social Security Disability Insurance (SSDI) benefits. Individual resource limit is $4,000, and Married couple resource limit is $6,000. The QDWI program provides assistance in paying Medicare Part A premiums to help individuals with disabilities return to work by providing them with support to pay their Medicare premiums while they transition back to the workforce.

To apply for a MSP, please contact your local state Medicaid office for more details and information on qualifying and applying for a MSP.