VIDEO: What is Part B and How Does it Work?

Medicare Part B (Medical Insurance)

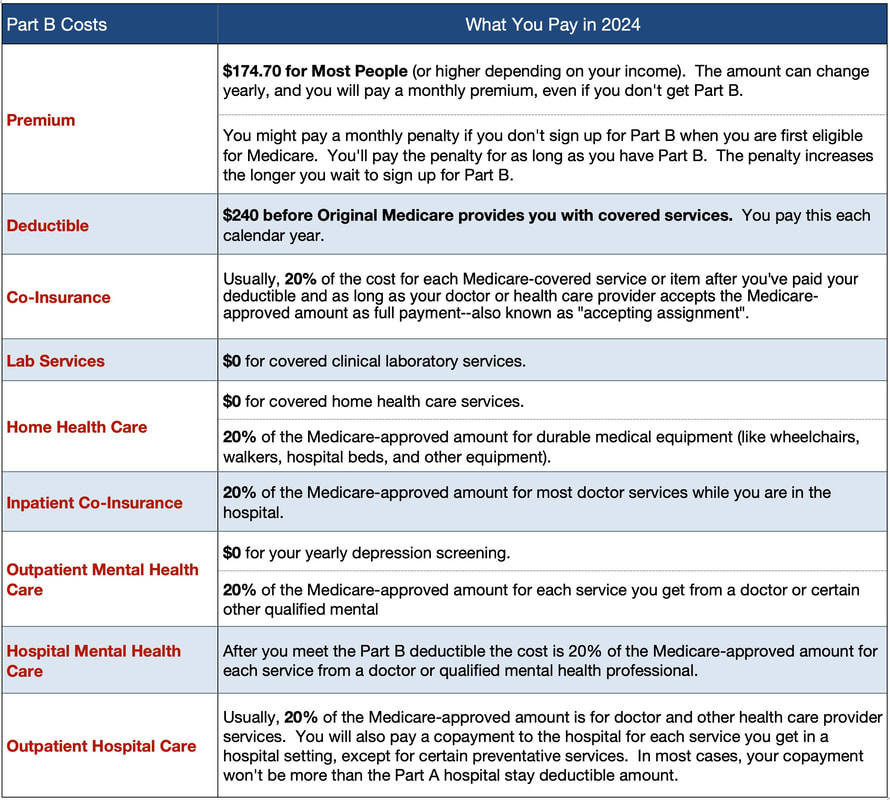

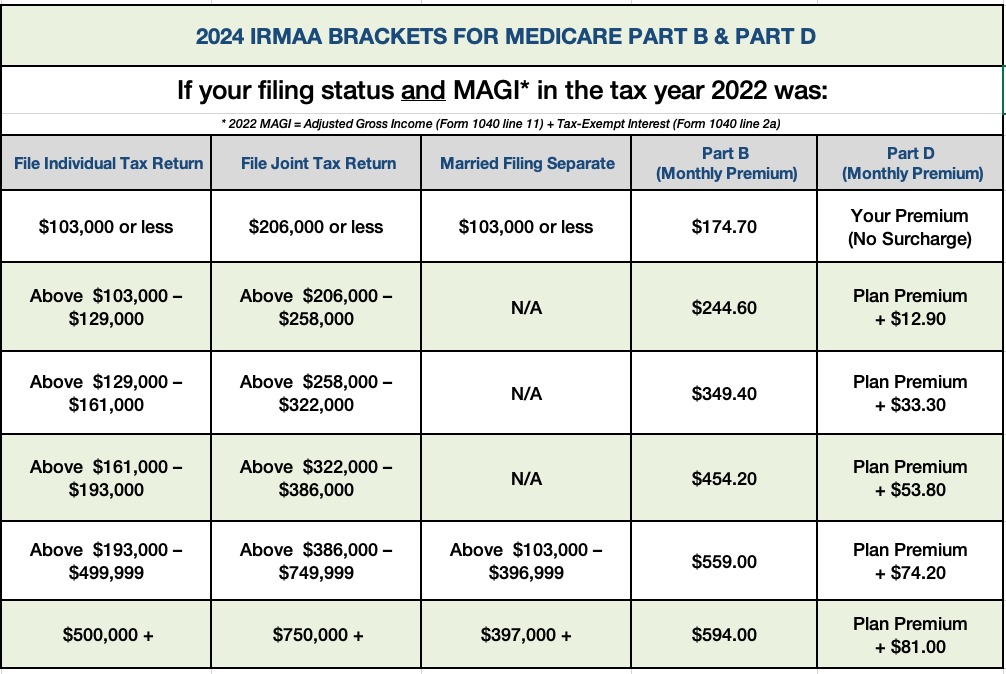

Medicare Part B is a voluntary program that requires payment of a monthly premium. The premium amount is based on income and may be subject to adjustment based on income changes and is called IRMAA. It is important to note that enrolling in Medicare Part B is not automatic. Individuals who are receiving Social Security benefits will be automatically enrolled in Medicare Part B, however those who are not receiving benefits must enroll during the Initial Enrollment Period, unless you're still working and have employer provided credible coverage. Contact your employer or human resources officer to verify credible coverage The Initial Enrollment Period begins three months before the individual turns 65 and ends three months after their 65th birthday. Failure to enroll during this period may result in a penalty and delayed coverage. (unless you choose to stay on your employer sponsored credible coverage plan) If you miss your IEP, you will need to wait for the General Enrollment Period (GEP) to enroll, which occurs annually from January 1 to March 31 and may incur late enrollment penalties payable for life. One of the key features of Medicare Part B is that it covers a wide range of healthcare services and supplies. This includes doctor visits, preventive care, laboratory tests, diagnostic imaging, vacinations, and medical equipment such as wheelchairs and oxygen tanks. Medicare Part B also covers outpatient mental health services, as well as certain prescription drugs that are administered in a medical setting. However, it is important to note that Medicare Part B does not cover all medical expenses. For example, it does not cover long-term care, dental care, or cosmetic procedures. Additionally, there may be certain limitations or restrictions on coverage for certain services or supplies. In general, Medicare Part B covers 80% of the cost of covered services, while beneficiaries are responsible for the remaining 20%, with no annual out of pocket maximum. Therefore it is important to consider a Medicare Supplement or Medicare Advantage Plan |

Contact UsMed Insure Your Way

(317) 372-3070 Carmel, Fishers, Fort Harrison, Greenwood, Indianapolis, Martinsville, Noblesville, and Plainfield Click Here to Email Us |